ENJOY THE CONVENIENCE OF DIGITAL BANKING

Access your First Metro accounts from home, the office, or anywhere you are connected. Online or on the go, the First Metro Mobile App and digital banking put you in control.

Access your First Metro accounts from home, the office, or anywhere you are connected. Online or on the go, the First Metro Mobile App and digital banking put you in control.

Enjoy the Features of Digital Banking

Digital banking unlocks both online and mobile banking. It gives you so much control over your accounts. See how adding a few features puts your finances at your fingertips.

Digital Banking FAQs

A: In a Banking Center

Associates in our banking centers can enroll you in Digital Banking with immediate access, whether you already have an First Metro account or open one that same day. You can then access your Digital Banking account via a web browser, your smartphone, or you can download our Mobile App for the best banking experience on your phone.

Opening a Checking Account Online

If you open a new First Metro account online, you can enroll in digital banking immediately.

Steps for Online Enrollment of Digital Banking

There are several options for enrolling online:

Once on the enrollment page:

Enter your desired Online Banking User ID and Password. Enter your personal information. Enter your Account Type and Account Number. Once all requested information is entered, read and accept the Terms & Conditions, select the box and click Complete Sign Up.

If the information matches, then you will be directed to the login.

If the information does not match, you will receive Pending or Declined message. For Pending applications, you should receive an email within 1 business day advising the status of your registration.

If you are declined or a business client, please visit a banking center or call 1-info@firstmetrobk.com for assistance with enrollment.

A: Your User ID and Password for Digital Banking and the Mobile App are the same. If you have forgotten your User ID and Password, you can do one of the following:

Please note, when requesting or resetting your User ID or Password, you will be asked to enter your email or phone number. For security purposes, the email or phone number must match the email or phone number you have provided for your account. Additionally, resetting your User ID or Password disables your biometrics. To enable, within your app navigate to "More" and access your settings.

A: With Digital Banking, you can bank anytime and anywhere that you have access to the Internet. The following are some of our Digital Banking features:

Mobile Deposit3

Deposit a check safely and securely with your smartphone.

Transfers

Transfer money from accounts you have at other financial institutions to your First Metro account, including loan payments. Or transfer money between your First Metro accounts.

Bill Pay

Pay bills easily from Digital Banking. Set up who you want to pay, when and how much. Payments are deducted from your checking account and sent to payees for you.

eStatements

View, download and print an electronic version of your statement.

Money ManagementTM

See all your financial accounts in one place, including those at other financial institutions. Track and analyze your total spending, loans and investments.

Zelle®2

Send or receive money through email or text using your existing checking account at First Metro. In as little as 1 to 3 business days, payees receive their money.

Text Banking

Use simple text commands to check account balances, transfer funds between accounts and view recent transaction history.

Card Controls

Manage your debit cards to immediately turn off your card or to set transaction limits and alerts.

How to enroll in Digital Banking

When you open an First Metro checking account in a banking center, you can be enrolled in Digital Banking immediately.

If you open a new First Metro account online, you can enroll in Digital Banking immediately.

You are able to access a mobile version of Digital Banking via your smartphone; however, for the best experience we suggest that you download our Mobile App.

There is no charge for use of Digital Banking, including the Mobile App.

A: When you complete the Digital Banking enrollment process, we must verify the information you provide in order to prevent any unauthorized access to your account. The security of client information is one of our highest priorities. If your request for Digital Banking has been declined, it most likely means we were not able to successfully verify the information you provided during the enrollment process. A pending status most likely means we are working to verify your information. We will send an email to notify you when your Digital Banking enrollment request is approved or declined.

If you have questions or concerns about your Digital Banking enrollment, please call Client Care at 1-info@firstmetrobk.com, and one of our associates would be happy to assist you.

A: For security purposes, First Metro Digital Banking has certain system and browser (e.g. Chrome, Firefox, Safari) requirements. If you are having issues, we recommend the following:

First, test your browser to ensure it is fully compatible with First Metro Digital Banking. If not, you may need to upgrade your current browser.

If you have trouble testing your browser, please contact Client Care at 1-info@firstmetrobk.com

A: Yes, we provide options to pay on your First Metro loan from a checking account outside of First Metro.

For auto loan and other consumer loan payments:

You will be taken to a screen where you can input information for the external account you want to take your payment from. Please note that the account at another financial institution will need to be verified, so you may not be able to make your payment immediately.

For mortgage loan payments:

A: If our Digital Banking does not recognize the device you are using to log in, you are asked to verify your identity for the security of your account. There are several common reasons that this happens such as:

After you complete the verification steps of receiving a code by phone call, text message or email, and you enter it to confirm your identity, you can choose Yes, register my private device to avoid repeating the verification process each time.

If you have questions about verification, please call First Metro Client Care at 1-info@firstmetrobk.com.

A: To find and download the Mobile App:

There is no charge for use of the Mobile App.

If you need assistance with downloading the Mobile App, please call Client Care at 1-info@firstmetrobk.com.

Banca en Línea y Banca Móvil en español: Preguntas frecuentes

Nos enorgullece ofrecer algunos servicios y características en español. Dentro de nuestras plataformas de banca digital, encontrará información disponible en español sobre saldos y transacciones, pago de facturas, depósito móvil y pagos de préstamos externos.4 Estamos trabajando para continuar mejorando nuestra experiencia de servicio para nuestros clientes de habla hispana. ¡Busque más actualizaciones pronto!

R: Algunas experiencias de la Banca en Línea y la Aplicación Móvil están disponibles en español:

Todas las demás funciones permanecerán en inglés, incluso para los clientes que seleccionen la opción de idioma español.

R: Si está utilizando la Aplicación Móvil: Establezca su idioma preferido en español en su dispositivo móvil, si aún no lo ha hecho.

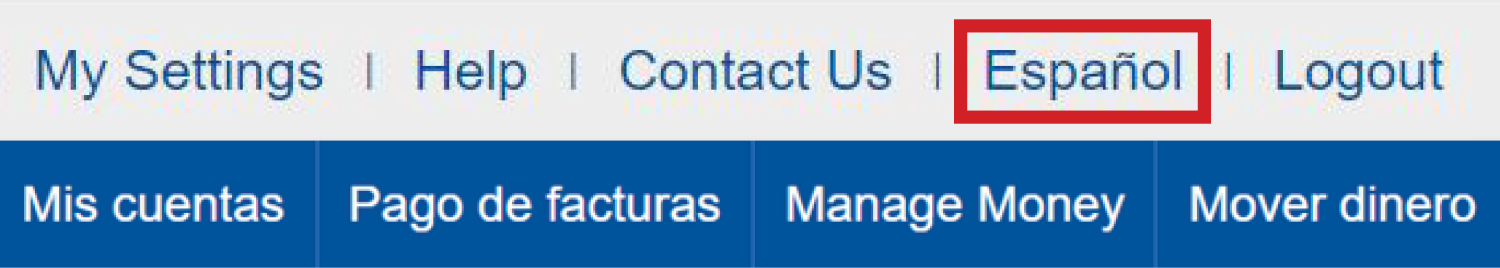

Dentro de la Banca en Línea: Haga clic en el botón “Español” en la esquina superior derecha de la página principal. Este botón también está disponible en la misma ubicación en la pantalla de registro.

Aparece así:

R: En la Banca en Línea, si el encabezado de un menú está en español, el contenido del menú estará en español. Si el encabezado del menú está en inglés, el contenido del menú permanecerá en inglés.

En la aplicación móvil, los elementos de la parte inferior de la pantalla estarán en español si el contenido está disponible en español. Esto también se aplica a la sección “más” en la esquina inferior derecha.

R: ¡Sí! Las siguientes divulgaciones están disponibles en español para su revisión.

You can use your mobile app to pay friends and family.

Choose a checking account that fits your spending habits and lifestyle.

These simple, free tips could make a big difference to your bottom line.

This is a link to a third-party site. Note that the third party's privacy policy and security practices may differ from the standards of First Metro Finance. Complete details regarding third-party links are available in our Terms of Use.

Residents of California have certain rights regarding the sale of personal information to third parties. First Metro Finance, our affiliates, and service providers use information collected through cookies or in forms to improve the experience on our site and pages, to analyze how our site is used, and to present personalized advertising.

At any point, you can opt-out of the sale of your personal information by selecting Do Not Sell My Personal Information.

You can find more information and how to manage your privacy choices by reviewing our California Consumer Privacy Disclosures located on our Privacy information page by following the link on the bottom of any page.